Driven to Divide: Insights & Perspectives

Exploring the forces and ideas that shape our divided world.

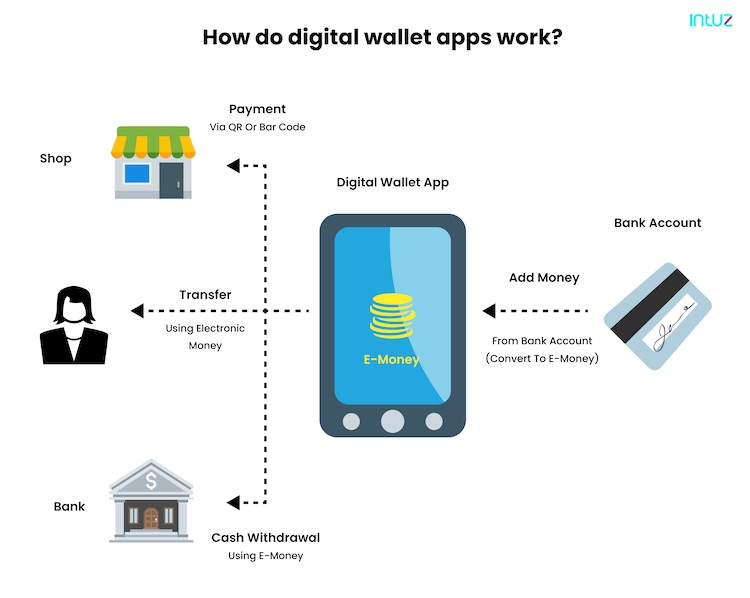

Ditch the Cash: Why Digital Wallet Integrations are the New Trend in Payments

Ditch cash for convenience! Discover why digital wallets are revolutionizing payments and why you need to make the switch today!

The Rise of Digital Wallets: How They’re Changing the Payment Landscape

The rise of digital wallets has been nothing short of transformative, reflecting a significant shift in consumer behavior and financial technology. With the increasing adoption of smartphones and contactless payment options, consumers are now more inclined than ever to store their payment information in virtual wallets rather than traditional physical wallets. This trend is fueled by enhanced convenience, security features, and the ability to access funds quickly and easily, leading many to question whether cash will soon become obsolete.

As digital wallets continue to gain traction, they are reshaping the payment landscape across various sectors. From retail to online shopping, businesses are adapting to accommodate these new payment methods. According to recent studies, digital wallets are expected to account for a significant share of transactions in the coming years. Furthermore, with features like loyalty programs and personalized offers integrated into these platforms, both consumers and retailers stand to benefit, enhancing the overall shopping experience.

Counter-Strike is a popular multiplayer first-person shooter game that pits teams of terrorists against counter-terrorists in various objective-based scenarios. Players can choose to participate in different game modes, which often involve bomb defusal or hostage rescue missions. If you're looking to enhance your gaming experience, you might consider checking out the betpanda promo code for some exclusive offers and bonuses.

10 Benefits of Using Digital Wallets Over Cash and Cards

As we embrace the digital age, digital wallets have emerged as a game-changer in the way we manage our finances. One of the most significant benefits is convenience; with just a few taps on your smartphone, you can make purchases without rummaging through your wallet for cash or cards. Additionally, digital wallets often offer enhanced security features, such as biometric authentication and tokenization, which help protect your sensitive information from fraud. This combination of ease of use and safety makes digital wallets a superior choice for modern consumers.

Another crucial advantage of using digital wallets is their ability to streamline your transaction history. Users can easily track their spending, categorize expenses, and even set budgets right from their mobile devices. Furthermore, many digital wallets come with loyalty programs, allowing users to earn rewards or cashback on everyday purchases. With these features, digital wallets not only simplify transactions but also enhance budgeting and savings, making them a smart alternative to traditional cash and cards.

Is Your Business Ready for Digital Wallet Integration? Key Insights to Consider

In today's fast-paced digital landscape, integrating digital wallets into your business model can significantly enhance customer experience and streamline transactions. However, before making this leap, it's crucial to evaluate whether your business is prepared for this integration. First, assess your current payment infrastructure; is it flexible and scalable enough to accommodate digital wallet technology? Consider the security protocols necessary to protect user data. Ensuring compliance with regulations, like GDPR or PCI DSS, is vital for building customer trust and safeguarding sensitive information.

Moreover, it’s important to understand your target audience. Are your customers tech-savvy and likely to use digital wallets, or do they prefer traditional payment methods? Analyzing customer behavior can provide insights into how much demand there is for this service. Additionally, examine the cost implications of integrating digital wallet solutions, including transaction fees and setup costs. Weighing these factors will help you make a well-informed decision that aligns with your business goals.