Driven to Divide: Insights & Perspectives

Exploring the forces and ideas that shape our divided world.

Crypto Regulation Updates: Navigating the Wild West of Digital Currency

Stay ahead in the fast-paced world of crypto with the latest regulation updates and expert insights. Navigate the wild west of digital currency today!

Understanding the SEC's Stance on Cryptocurrency: What Investors Need to Know

The SEC, or Securities and Exchange Commission, plays a crucial role in regulating the cryptocurrency market in the United States. As an investor, it is essential to understand how the SEC's regulations affect your investments. The SEC primarily focuses on protecting investors, maintaining fair markets, and promoting capital formation. This includes classifying certain cryptocurrencies as securities, which subjects them to rigorous regulatory scrutiny. When considering an investment in a cryptocurrency, you should ask whether it meets the criteria defined by the Howey Test, which determines if an asset qualifies as a security based on its expectations of profit derived from the efforts of others.

In addition to classifying specific coins and tokens, the SEC has taken action against numerous Initial Coin Offerings (ICOs) for failing to comply with securities laws. It's crucial for investors to stay updated on these policies, as violations can lead to significant financial penalties and the loss of invested capital. For anyone looking to venture into the world of cryptocurrency, understanding the SEC's approach and remaining compliant with their regulations will not only protect investments but also promote a healthier trading environment. As regulations evolve, investors are encouraged to seek out reliable sources and consider consultation with legal experts to navigate the complex landscape of cryptocurrency.

Counter-Strike is a highly popular first-person shooter game that focuses on team-based gameplay and strategy. Players can immerse themselves in intense matches, competing as either terrorists or counter-terrorists. For those looking to enhance their gaming experience, using a betpanda promo code can provide exciting bonuses and offers.

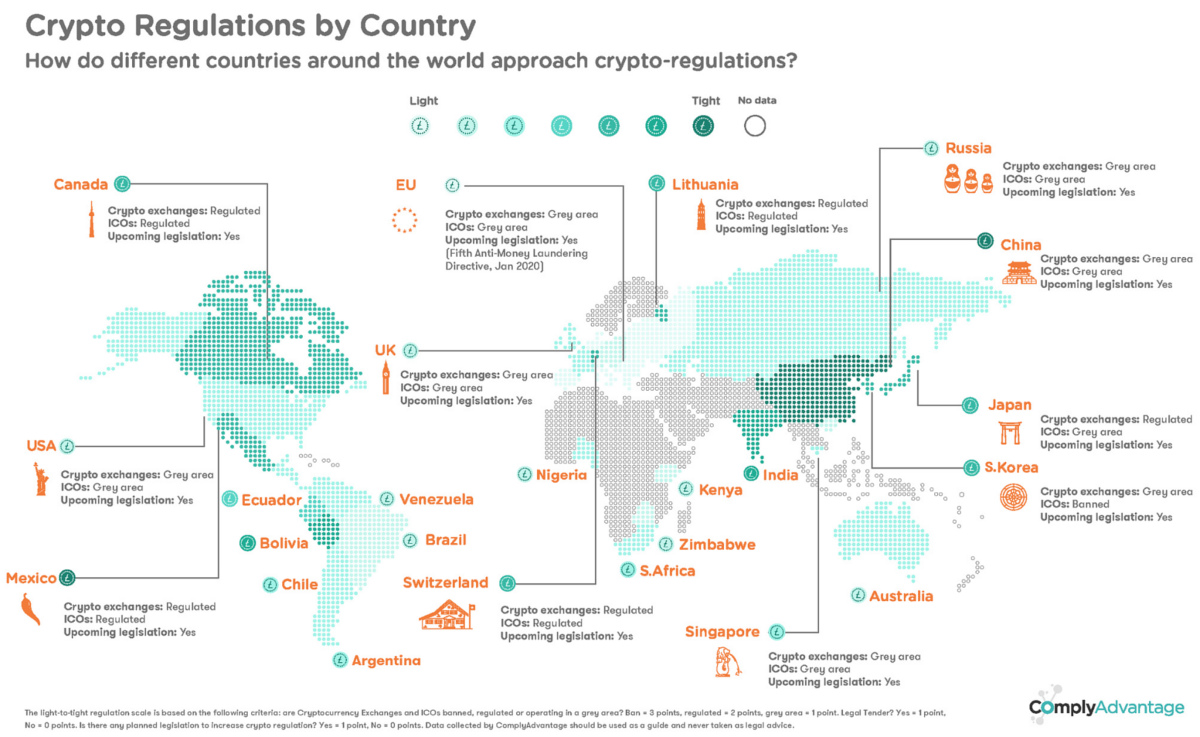

Key Developments in Global Crypto Regulation: A Country-by-Country Breakdown

The landscape of global crypto regulation is evolving rapidly, as countries around the world increasingly recognize the need for frameworks that govern digital currencies. In the United States, the Securities and Exchange Commission (SEC) has taken a proactive stance, issuing guidelines that clarify the status of cryptocurrencies as securities. Meanwhile, the European Union is working on the Markets in Crypto-Assets (MiCA) regulation, which aims to create a unified framework for the crypto industry across its member states. In contrast, countries like China have implemented strict bans on cryptocurrency trading and Initial Coin Offerings (ICOs), opting instead to promote their own digital yuan.

In Asia, Japan has emerged as a leader in crypto regulation by formally recognizing cryptocurrencies as legal property, establishing a licensing framework for exchanges that prioritize consumer protection. South Korea, after initially imposing bans, is now working towards a comprehensive regulatory framework that could enhance investor confidence. Conversely, countries such as El Salvador are pioneering a new approach by adopting Bitcoin as legal tender, raising debates on the sustainability and implications of such moves. This country-by-country breakdown highlights the diverse approaches to crypto regulation and the ongoing balancing act between fostering innovation and ensuring financial stability.

Is Your Crypto Investment Safe? Exploring Regulatory Protections for Investors

In recent years, the surge in cryptocurrency investments has sparked questions about the safety and security of these digital assets. Investors need to understand that while the potential for high returns is attractive, the lack of regulation in many markets poses significant risks. It's essential to explore regulatory protections that are increasingly being put in place to safeguard investors. For instance, in various countries, regulators are implementing frameworks designed to monitor exchanges and other platforms, ensuring they adhere to strict standards. This includes implementing Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, which aim to prevent fraud and protect consumers.

Moreover, as governments begin to recognize the need for investor protections, initiatives are being rolled out to improve transparency and accountability within the crypto space. For example, the U.S. Securities and Exchange Commission (SEC) has ramped up its scrutiny of Initial Coin Offerings (ICOs) and trading platforms to ensure compliance with existing securities laws. Investors should stay informed about these developments, as understanding the landscape of regulatory protections can help mitigate risks associated with investing in cryptocurrencies. By choosing platforms that prioritize regulatory compliance, investors can enhance the security of their investments and make more informed decisions.