Driven to Divide: Insights & Perspectives

Exploring the forces and ideas that shape our divided world.

Whole Life Insurance: Your Lifetime Ticket to Financial Security

Unlock lifelong peace of mind with whole life insurance—your ultimate ticket to secure your family's financial future!

Understanding Whole Life Insurance: Key Benefits and Features

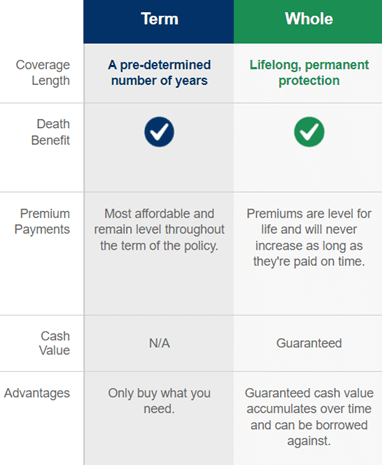

Whole life insurance is a permanent life insurance policy that offers both a death benefit and a cash value component. Unlike term life insurance, which provides coverage for a specific period, whole life insurance lasts for the insured's entire lifetime, as long as premiums are paid. One of the key benefits of whole life insurance is its predictable premiums and guaranteed cash value accumulation, which grows at a steady rate. This makes it an attractive option for individuals looking to secure their family's financial future while also building a savings component. For more detailed insights, you can check out Investopedia.

Another essential feature of whole life insurance is its death benefit, which provides a financial safety net for beneficiaries upon the policyholder's passing. This benefit can be used to cover funeral expenses, pay off debts, or provide ongoing financial support. Additionally, policyholders have the opportunity to borrow against the cash value of their policy, making it a versatile financial tool. It is important to note that loans against the policy’s cash value can reduce the death benefit if not repaid, so it's crucial to manage this aspect carefully. For more information on the benefits of whole life insurance, explore NerdWallet.

Is Whole Life Insurance Right for You? Pros and Cons Explained

When considering whole life insurance, it's essential to weigh the advantages and disadvantages it offers. One of the primary benefits is that it provides permanent coverage, ensuring that your beneficiaries receive a payout upon your death, regardless of when that occurs. Additionally, whole life policies accumulate cash value over time, which you can borrow against if needed. This makes it a dual-purpose financial vehicle—serving both as an insurance policy and a savings account. However, these benefits come at a cost; whole life insurance tends to have significantly higher premiums compared to term insurance. For more insights, check out this article on Investopedia.

On the flip side, there are notable downsides to whole life insurance that potential policyholders should consider. The complexity of these products can make them challenging to understand, which leads some individuals to make uninformed choices. Additionally, if you decide to cancel your policy early, you may face substantial penalties and lose a significant amount of your investment. It's crucial to assess your long-term financial goals, risk tolerance, and overall estate planning needs before diving into a whole life policy. For further details, you can review this guidance from NerdWallet.

How Whole Life Insurance Can Build Your Wealth Over Time

Whole life insurance is not just a safety net for your loved ones; it can also serve as a powerful tool for building wealth over time. Unlike term life insurance, whole life policies provide coverage for your entire life and accumulate cash value as you pay your premiums. This cash value grows at a guaranteed rate, meaning that over time, you can access these funds for various purposes, such as supplementing retirement income, funding education, or even borrowing against it for investments. By choosing a reliable provider, you can ensure your investment grows steadily. For more insights on how whole life insurance works, check out Investopedia.

One of the standout features of whole life insurance is that the cash value grows on a tax-deferred basis. This means that you won’t owe taxes on the growth until you withdraw the funds, allowing you to maximize your investment over the long term. Moreover, many policies offer dividends, which can be reinvested to further enhance your cash value. This dual benefit of guaranteed growth and potential dividends makes whole life insurance a unique and effective way to build wealth. To learn more about the advantages of whole life insurance, visit NerdWallet.