Driven to Divide: Insights & Perspectives

Exploring the forces and ideas that shape our divided world.

Term Life Insurance: Your Life's Safety Net or Just a Money Pit?

Is term life insurance your ultimate safety net or a costly waste? Discover the truth behind your financial security!

Is Term Life Insurance Worth It? A Comprehensive Guide

When considering whether term life insurance is worth it, it's essential to examine your personal circumstances and financial goals. Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years, making it a more affordable option compared to permanent life insurance. This type of policy is particularly beneficial for individuals with dependents, as it ensures that loved ones are financially secure in the event of unexpected passing. To determine its value, assess your current financial obligations, such as mortgages, children's education costs, and other debts, which can help you understand how much coverage you truly need.

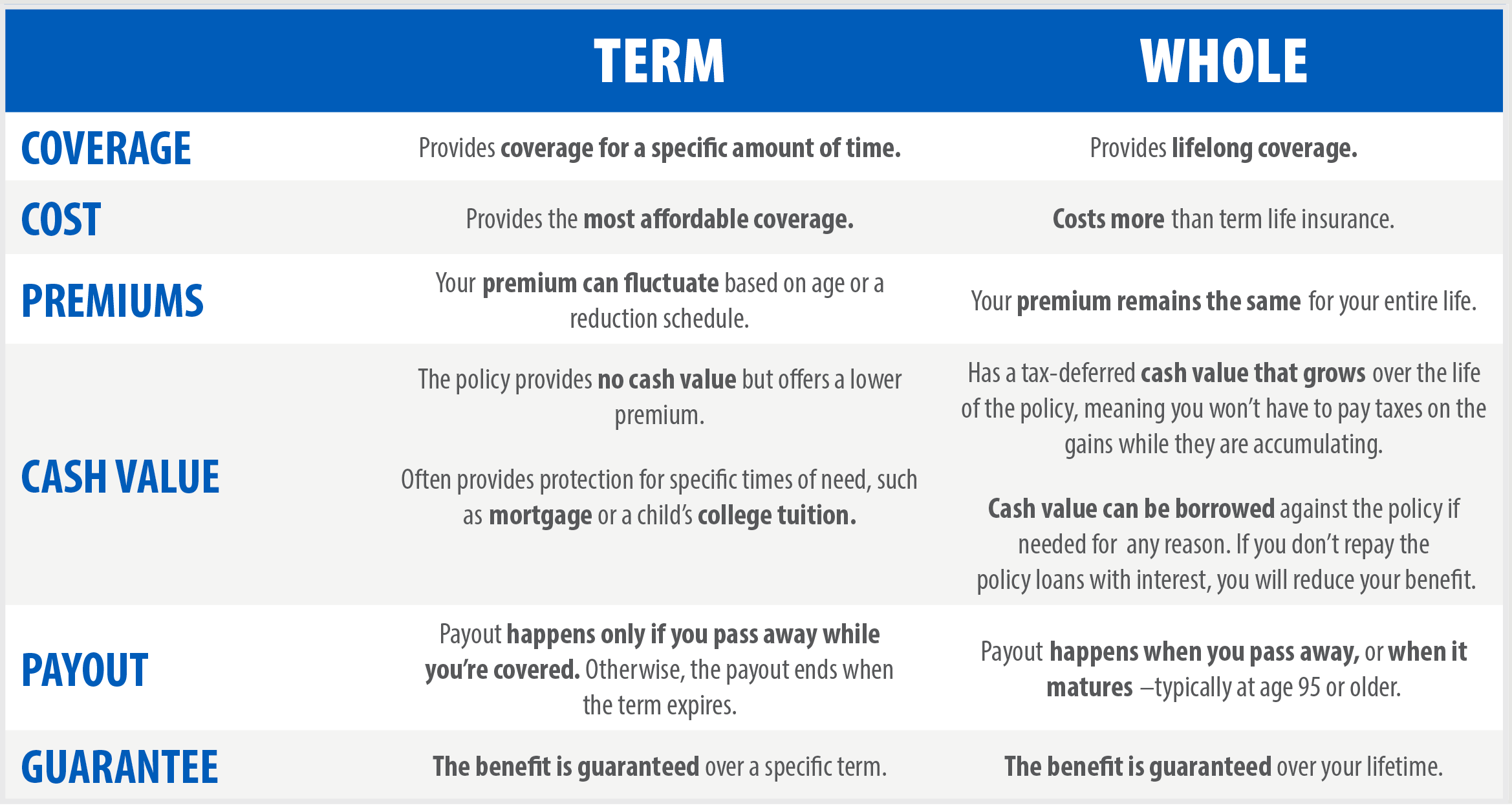

Another significant advantage of term life insurance is its simplicity and ease of understanding. With straightforward terms and conditions, policyholders can easily grasp what they are paying for and when benefits will be paid out. However, it is crucial to remember that once the term expires, the coverage ends, and unlike permanent insurance, there is no cash value accumulated. To make a well-informed decision, consider factors such as your age, health status, and the likelihood of needing coverage in the future. Overall, for many individuals, particularly younger families looking for short-term coverage at lower costs, term life insurance can be a smart and worthwhile investment.

The Pros and Cons of Term Life Insurance: A Deep Dive

Term life insurance is a popular choice among individuals seeking affordable coverage for a specified period, usually ranging from 10 to 30 years. One of the main advantages is its low cost compared to permanent life insurance policies. This affordability allows policyholders to secure substantial coverage for loved ones without straining their finances. Additionally, term life insurance offers flexibility; many policies can be converted to permanent insurance as financial needs evolve. However, it’s essential to remember that once the term expires, coverage ceases unless the policy is renewed, which could come at a higher premium as the insured ages.

On the flip side, there are notable cons to consider when opting for term life insurance. First and foremost, it does not build cash value, unlike whole or universal life insurance, meaning you don't have an investment component with a term policy. Furthermore, if you outlive your policy without renewing or converting, your beneficiaries will receive no payout, which can be a significant risk for long-term planners. Ultimately, when evaluating term life insurance, individuals must weigh these pros and cons carefully, considering their unique circumstances and future financial goals.

How Much Term Life Insurance Do You Really Need?

Determining how much term life insurance you really need can seem overwhelming, but it fundamentally hinges on your specific financial situation and family needs. A common method to calculate the necessary coverage is to consider factors such as your annual income, existing debts, and future expenses such as mortgage payments, children's education, and daily living costs. A general rule of thumb is to aim for coverage that is at least 10 to 15 times your annual salary. This can ensure that your loved ones are financially secure in case of unforeseen events.

Another effective way to assess your needs is to create a needs analysis. Start by listing all your current financial obligations and forecasting future expenses. For instance, if you have young children, you may want to factor in their educational expenses and any debts that would be a burden on your family. Additionally, consider your spouse’s earning potential and whether they would need additional support. By consolidating these details, you can arrive at a clearer picture of how much term life insurance is essential for protecting your family’s financial future.