Driven to Divide: Insights & Perspectives

Exploring the forces and ideas that shape our divided world.

Insurance on a Shoestring: Affordable Coverage Hacks

Discover clever insurance hacks to save big! Unlock affordable coverage tips that won’t break the bank. Start saving today!

Top 5 Affordable Insurance Hacks You Need to Know

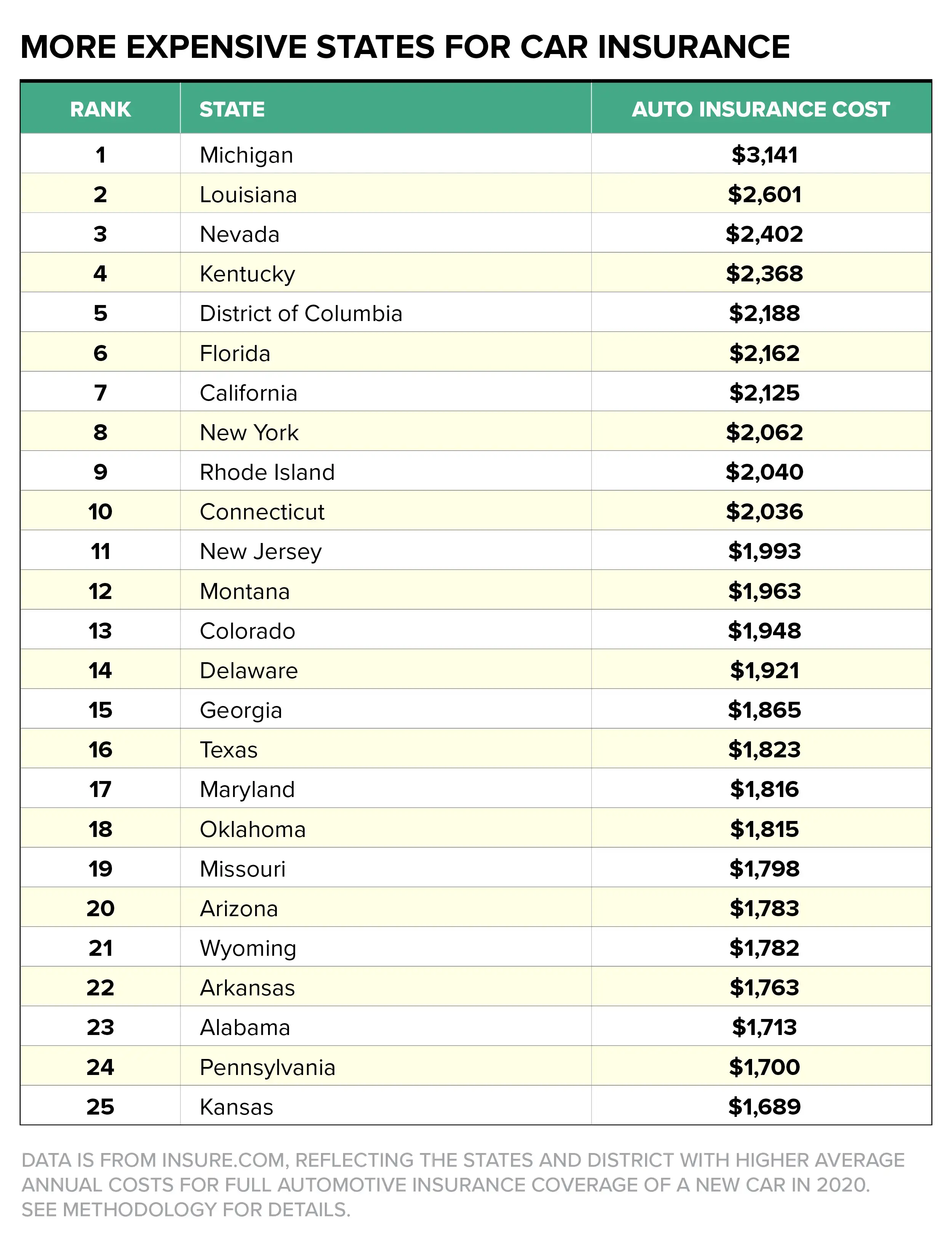

Finding affordable insurance can seem daunting, but there are several hacks that can help you save cash without sacrificing coverage. One of the best tips is to shop around and compare rates from multiple providers. Websites like Insure.com offer tools that allow you to compare quotes from various insurers, ensuring you get the best deal possible. Additionally, consider bundling your policies; many companies provide significant discounts if you combine your car, home, and other insurance types into one package.

Another important strategy is to review your coverage periodically to ensure you are not overpaying for unnecessary features. You might discover that certain coverage limits or add-ons are no longer required, or that your vehicle value has decreased, giving you a chance to lower your premiums. For more detailed advice, visit Bankrate.com, where you can find expert articles on maintaining affordable insurance while getting adequate protection. Finally, don’t forget to ask about discounts—many insurers offer reduced rates for safe driving records, low mileage, or even for being a good student.

How to Find Budget-Friendly Coverage Without Sacrificing Protection

Finding budget-friendly coverage can seem daunting, but it is possible to secure reliable protection without breaking the bank. Start by comparing quotes from multiple insurance providers. Websites like Insure.com offer tools to streamline this process, allowing you to easily compare prices and coverage options. Additionally, consider adjusting your deductibles. Increasing your deductible can lower your premium significantly, but ensure that you can afford that amount in case of a claim.

Moreover, don't hesitate to take advantage of discounts offered by insurers. Many companies provide discounts for safe driving records, bundling policies, or even being a member of certain organizations. It's also wise to regularly review your policy to ensure it meets your current needs without any unnecessary add-ons. For more tips on optimizing your insurance coverage, check out this guide from Nolo.

Is it Possible to Get Insurance on a Shoestring Budget?

If you're worried about affording insurance, you're not alone. Many individuals seek ways to get insurance on a shoestring budget. Fortunately, there are several strategies that can help you find affordable options. First, consider health insurance marketplaces, where you can compare various plans and possibly qualify for subsidies that make coverage more affordable. Additionally, researching local non-profit organizations or community health resources can uncover alternatives that provide essential coverage at little or no cost.

Another great way to cut costs is by increasing your deductible. Higher deductibles often lower your monthly premiums, allowing you to maintain coverage while saving money. However, be sure to assess your financial situation to avoid potential out-of-pocket expenses. Lastly, don't forget to take advantage of Medicaid or Medicare if you qualify, as these government programs can provide valuable support for those on tight budgets. By being proactive and exploring these options, you can successfully navigate the world of insurance without breaking the bank.