Driven to Divide: Insights & Perspectives

Exploring the forces and ideas that shape our divided world.

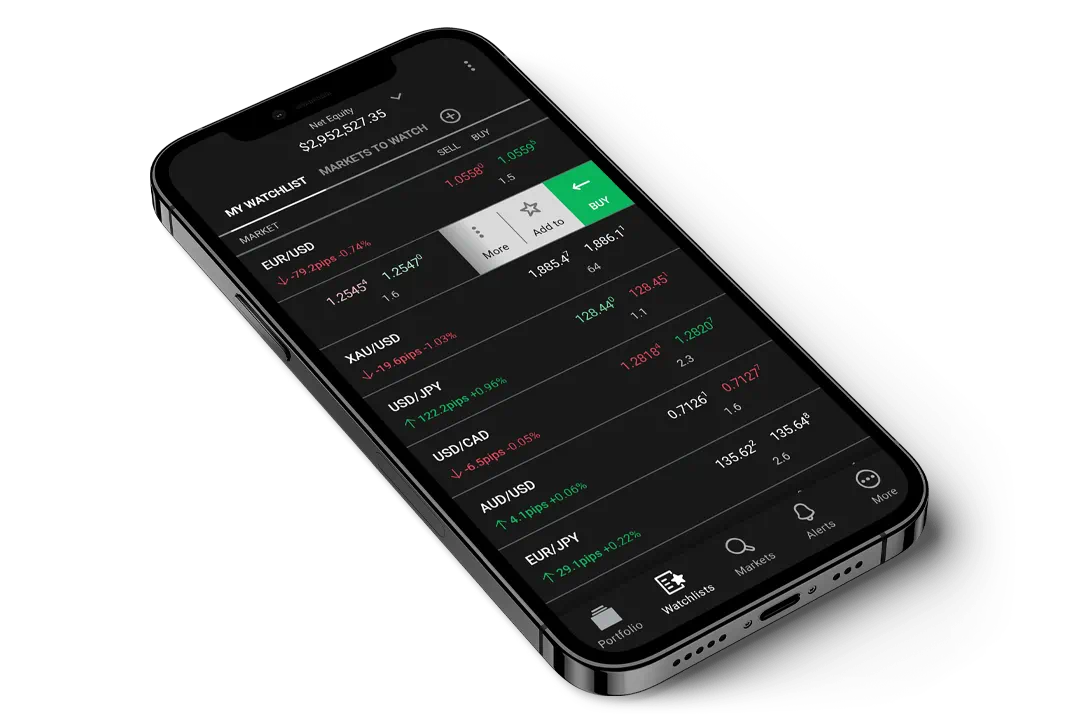

Currency Conundrum: When to Dive into Forex Trading

Unlock the secrets of Forex trading! Discover the best times to dive in and maximize your profits in the Currency Conundrum.

Understanding Forex Trading: Key Indicators and Timing Strategies

Forex trading, or foreign exchange trading, involves the buying and selling of currencies to profit from fluctuations in exchange rates. To navigate this dynamic market effectively, traders rely on key indicators that help predict currency movements. Among the most important indicators are moving averages, Relative Strength Index (RSI), and Bollinger Bands. Moving averages smooth out price data to identify trends over a specific period, while the RSI measures the speed and change of price movements, helping traders determine overbought or oversold conditions. Bollinger Bands provide insight into market volatility, which can indicate potential price breakouts or reversals.

Timing strategies play a crucial role in successful Forex trading. One of the most effective approaches is the use of support and resistance levels. These levels indicate potential price barriers where the market might reverse direction. Traders often look for entry points near these levels, coupled with signals from key indicators, to maximize their chances of profitability. Additionally, being aware of market sentiment and economic events, such as interest rate announcements or geopolitical developments, can significantly enhance a trader's ability to time their trades effectively in the fast-paced Forex market.

The Best Times to Enter the Forex Market: A Comprehensive Guide

Entering the Forex market at the right time is crucial for maximizing your trading potential. The Forex market operates 24 hours a day, but the ideal trading times are influenced by market sessions that coincide with major financial centers around the globe. Typically, the market is most active during the overlap of the London and New York sessions, which occurs from 8 AM to 12 PM EST. During this period, traders can benefit from increased volatility, tighter spreads, and significant price movements, making it an opportune time for both novice and experienced traders alike.

In addition to understanding market sessions, traders should also consider economic calendars that detail important news releases and events affecting currency values. Major economic indicators, such as employment rates, inflation reports, and interest rate decisions, can cause substantial price fluctuations. Timing your entry during these significant releases can lead to increased trading opportunities, but also higher risks. Therefore, it’s essential to strike a balance between seizing potential profit moments and managing risks effectively, especially during high-impact announcements.

Is Forex Trading Right for You? Assessing Your Readiness and Market Conditions

Deciding if Forex trading is right for you involves a careful assessment of both your personal circumstances and the current market conditions. First, consider your risk tolerance; trading in the foreign exchange market can lead to significant financial gains, but it also comes with substantial risks. Ask yourself the following questions:

- Are you comfortable with the possibility of losing money?

- Do you have a reliable strategy to mitigate risks?

- How much time can you dedicate to learning and trading?

In addition to personal readiness, it’s crucial to analyze the market conditions. The Forex market is influenced by a variety of economic indicators, geopolitical events, and changes in interest rates. To increase your chances of success, you should stay informed about global economic news and understand how these factors impact currency valuations. Familiarizing yourself with current market trends and potential volatility will not only enhance your trading strategy but also help determine the right time to enter or exit a trade. Remember, awareness and adaptability are key in navigating the ever-changing landscape of Forex trading.